- News all the latest

- Theme Park explore the park

- Resort tour the resort

- Future looking forward

- History looking back

- Community and meetups

-

ℹ️ Heads up...

This is a popular topic that is fast moving Guest - before posting, please ensure that you check out the first post in the topic for a quick reminder of guidelines, and importantly a summary of the known facts and information so far. Thanks. - Thread starter Lurker

- Start date

- Favourite Ride

- VelociCoaster (Islands of Adventure)

- Favourite Ride

- VelociCoaster (Islands of Adventure)

- Favourite Ride

- Fury 325

- Favourite Ride

- Pirates of the Caribbean - Paris

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

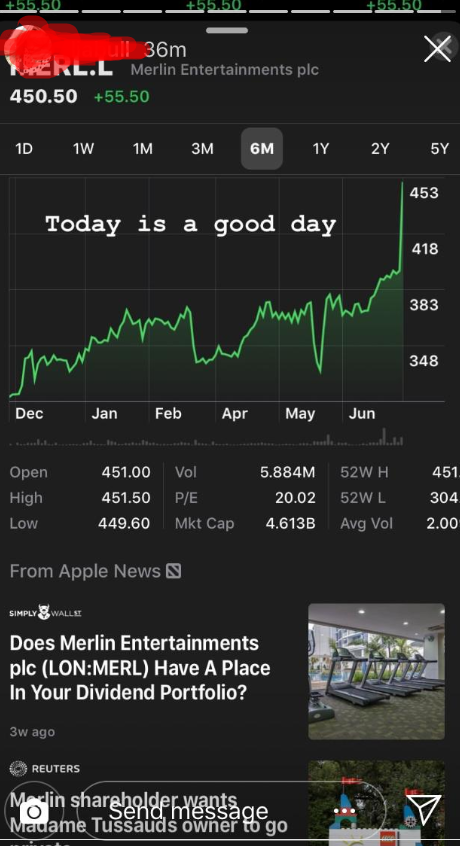

Merlin Entertainments: General Discussion

ChristmasPud

TS Member

Sorry I don't understand what you mean, but I meant I'd personally been hoping that Merlin would shake the public company status for years because I just didn't think it could do any favours for their parks on the ground.Did you have a private owner on mind?

Im sure its a complex situation to unpick and all that concerns us (park visitors) is better long term development of the parks, but that won't come from a public structure. It also needs competition and less homogeny in the industry but that's a different problem.

imanautie

TS Member

I mean a particular set of preferred new overlords for merlin.Sorry I don't understand what you mean, but I meant I'd personally been hoping that Merlin would shake the public company status for years because I just didn't think it could do any favours for their parks on the ground.

Im sure its a complex situation to unpick and all that concerns us (park visitors) is better long term development of the parks, but that comes from competition, a private structure and a better approach from Merlin HQ

Sent from my Swift 2 Plus using Tapatalk

ChristmasPud

TS Member

So long as they don't come steaming in with zero understanding of theme parks, fire everyone regardless of their merit and think they're gonna make easy billions, only to quickly realise they can't and sell it in a worse state than before— like what Charterhouse and DIC did!I mean a particular set of preferred new overlords for merlin.

So in that sense Blackstone seems to be a safe option

bluesonichd

TS Member

We’re there not decent park expansion under charter house and DIC ?

I still can’t see there being any decent level of investment, not like any of the European parks seam to do.

I still can’t see there being any decent level of investment, not like any of the European parks seam to do.

Not the first time Blackstone have done something like this (by far) - it's what they specialise in.

Back in 2006 they bought Center Parcs UK and took it back to private ownership (i.e. de-listed it from the stock exchange). Purchase price was £1.1billion. They invested heavily in the business & sold it on for £2.4billion in 2015.

I suspect there will be more than a few happy Merlin employees (permanent ones) who will be getting a windfall if they happen to own Merlin shares.

Back in 2006 they bought Center Parcs UK and took it back to private ownership (i.e. de-listed it from the stock exchange). Purchase price was £1.1billion. They invested heavily in the business & sold it on for £2.4billion in 2015.

I suspect there will be more than a few happy Merlin employees (permanent ones) who will be getting a windfall if they happen to own Merlin shares.

Andrew

Former TS Team Member

Ooh, so we could be seeing Merlin's value increase! This can only mean one thing; heavy investment!

It really means no change to the parks but bigger bonuses for the board as a ‘job well done’. Don’t kid yourself

ChristmasPud

TS Member

Tussauds (once it ran parks) was always under a company similar to Blackstone, Pearson Plc, and was heavily influenced by Pearson. They gave Tussauds a great run considering, massively growing the parks, improving Chessington and Alton Towers through the 1990s. But then sold it off in 1998 when they decided to cut their leisure division.We’re there not decent park expansion under charter house and DIC ?

Under Charterhouse, Tussauds notably changed from developing parks with big new areas and rides like Nemesis, Katanga Canyon/Haunted House, Transylvania etc, to Oblivion, Air, Beanoland and all of Thorpe in the early 2000s. So there was continued big investment but it was generally a bit more short term and cheaper approach, with Thorpe getting the best out of it and Chessington in big decline.

I'm pretty sure this was the time when the new parent company pushed out all the old Tussauds lot too, including John Wardley (and others)

Then in 2005 DIC took over, did almost nothing and saw some of the cheapest, worst developments of the time. They cut the theme out of theme park completely, then hurredly sold to Merlin.

So there's never one big golden solution but it shows just how much parent ownership influences the parks

What has Merlin's value got to do with "heavy investment"? Is £4.8Bn not enough to invest properly already?Ooh, so we could be seeing Merlin's value increase! This can only mean one thing; heavy investment!

Matt N

TS Member

What I mean is that in order to increase Merlin's value, they surely need to invest to some degree.What has Merlin's value got to do with "heavy investment"? Is £4.8Bn not enough to invest properly already?

Islander

TS Member

I mean, under what authority do you say this? It goes against what most are sayingIt really means no change to the parks but bigger bonuses for the board as a ‘job well done’. Don’t kid yourself

I suspect there will be more than a few happy Merlin employees (permanent ones) who will be getting a windfall if they happen to own Merlin shares.

Indeed there are.

What I mean is that in order to increase Merlin's value, they surely need to invest to some degree.

Merlin's vision on increasing value has been to increase the number of new attractions; not the number of investments in pre-existing attractions. Hence why Legoland theme parks and Midways have been cropping up everywhere like breeding bunnies because it is a cheap copy/paste formula to do so.

By removing the shareholders from the equation, guest spending will become more critical and we all know the only way that will happen is with investment being made into the pre-existing attractions.

Don't expect this to be a quick turnaround though. They aren't suddenly going to announce a major coaster and dark in every park for next year. This will very much be a long-term move, albeit a welcome one nonetheless.

Matt N

TS Member

Does this mean that things like the next major investment at Thorpe potentially being pushed forward? Or do you mean from an improvements point of view?By removing the shareholders from the equation, guest spending will become more critical and we all know the only way that will happen is with investment being made into the pre-existing attractions.

Don't expect this to be a quick turnaround though. They aren't suddenly going to announce a major coaster and dark in every park for next year. This will very much be a long-term move, albeit a welcome one nonetheless.

ChristmasPud

TS Member

What it means in practical terms could be anything or nothing, we will simply have to find out. In a brand new series of The Only Way Is Merlin coming to you soon.Does this mean that things like the next major investment at Thorpe potentially being pushed forward? Or do you mean from an improvements point of view?

Alsty

TS Member

I'm not sure it's that simple. For example, if they got more visitors to their attractions, they could claim that their existing rides are "worth" more.What I mean is that in order to increase Merlin's value, they surely need to invest to some degree.

Capex is a strange thing as you trade cash for an asset, in this case rides. The asset has a value which is less measurable.

I'm very optimistic about the involvement of the Kirkbi family, I just hope this isn't a holding position before they can take all the Lego interests and leave Blackstone with the rest. Perhaps the closeness in operations between the Discovery Centres and Sea Life (and in turn the Sea Life centres and the non-Legoland parks) will prevent that from happening easily.

Either way, I agree this is probably a good thing for the Merlin parks in terms of investment in rides and perhaps accommodation quality, but don't expect a private equity firm like Blackstone doing anything which reduces their ability to empty their guests' wallets.

Either way, I agree this is probably a good thing for the Merlin parks in terms of investment in rides and perhaps accommodation quality, but don't expect a private equity firm like Blackstone doing anything which reduces their ability to empty their guests' wallets.

evilcod

TS Member

Either way, I agree this is probably a good thing for the Merlin parks in terms of investment in rides and perhaps accommodation quality, but don't expect a private equity firm like Blackstone doing anything which reduces their ability to empty their guests' wallets.

I think the difference is that whilst the public shareholders want to empty pockets as quickly as possible a firm like Blackstone will see the advantage of emptying more pockets over a longer time period which can only be done with investment.

Very true. What I was hinting at was that, as one example, it's unlikely to mean they will bin off or even curtail paid Fastrack. Might mean they will manage it better (for example, with investment in Qbot).I think the difference is that whilst the public shareholders want to empty pockets as quickly as possible a firm like Blackstone will see the advantage of emptying more pockets over a longer time period which can only be done with investment.