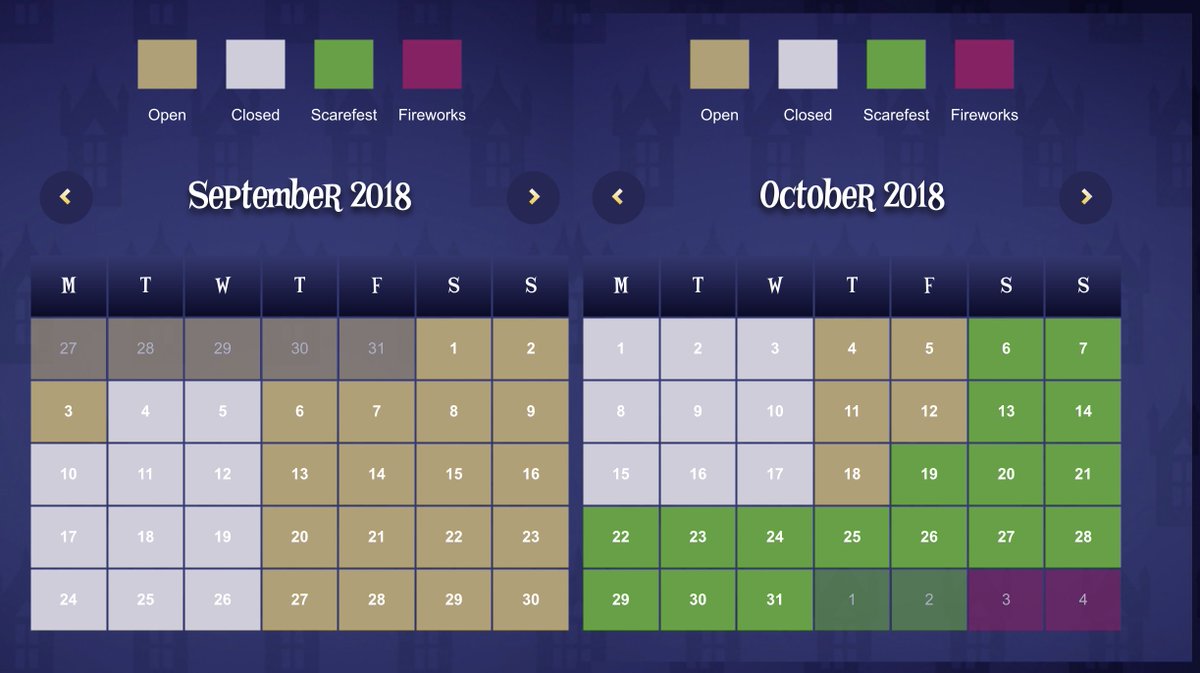

Closing more dates? I thought that with the new SW8, that the gate numbers will be up. So anyone planning to do the Scarefest on the Sunday and then book a resort stay to visit the park on the Monday, won't be able to do so now, so the resort will be losing out on hotel bookings. Yet they are planning to build more lodges?

- News all the latest

- Theme Park explore the park

- Resort tour the resort

- Future looking forward

- History looking back

- Community and meetups

-

ℹ️ Heads up...

This is a popular topic that is fast moving Guest - before posting, please ensure that you check out the first post in the topic for a quick reminder of guidelines, and importantly a summary of the known facts and information so far. Thanks. - Thread starter MakoMania

- Start date

- Status

- This topic has been locked. No further replies can be posted.

- Favourite Ride

- Steel Vengeance, Cedar Point

- Favourite Ride

- Colossus

- Favourite Ride

- VelociCoaster (Islands of Adventure)

- Favourite Ride

- Voltron Nevera

- Status

- This topic has been locked. No further replies can be posted.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

2018: General Discussion

That's a good point. If you can't use your pass Friday, Saturday or Sunday..... and the park is closed Monday, Tuesday Wednesday..... I'd say there are grounds to contact trading standards over this!

Standard pass exclusions only apply for August & 1st, 2nd September. So the midweek closure has no impact in that regards.

AstroDan

TS Team

I am certain we will see further cuts for 2018 in the near future. Far from cutting spending, with a major new attraction, everything should be going in to Alton Towers new season to make sure it is the absolute best.

Merlin Entertainments obviously have no faith in their parks in terms of being able to deliver and will continue to blame everything but their own operation for the downturn.

Merlin Entertainments obviously have no faith in their parks in terms of being able to deliver and will continue to blame everything but their own operation for the downturn.

WickerManiac

TS Member

I am certain we will see further cuts for 2018 in the near future. Far from cutting spending, with a major new attraction, everything should be going in to Alton Towers new season to make sure it is the absolute best.

Merlin Entertainments obviously have no faith in their parks in terms of being able to deliver and will continue to blame everything but their own operation for the downturn.

I agree with this. Merlin, as a Public Ltd Company, now, have (due to their own poor management), gotten themselves into a viscous cycle.

They can, either, invest heavily to try and regain guest attendance and improve face/satisfaction, yielding higher attendances in the future. This, on the other hand, would result in an unacceptable short term loss which wouldn't be accepted by the company's shareholders. Alternatively, and with their current approach: erode the core product and *attempt* to increase total spend per customer, which will result in customer dissatisfaction, and lower attendances.

It is also of my belief that Merlin's key figures: Nick Varney, Justin Platt and the new French CFO who I can't remember have presided over the utter deterioration of their parks and their current state. It is also worth noting that this management have put themselves in a situation where they actually have very little power if they want to keep their jobs.

My conclusion is two-fold: I can assure you if they increased operating costs and improved the core product in favour of increased profits, the shareholders would be ousting Nick at the next AGM. I can also conclude that the ultimate failings of this company in respect to their RTP division was the flotation of the business.

Anyone else agree?

I've also notice on the Merlin Holiday Club, that they are charging around £40 more for an accessible lodge compared to a non accessible lodge in the EV

On the Alton Towers site, there is no difference between the accessible lodges and non accessible lodges, but obviously at a higher price than those on the Merlin Holiday Club site.

On the Alton Towers site, there is no difference between the accessible lodges and non accessible lodges, but obviously at a higher price than those on the Merlin Holiday Club site.

Last edited:

Matt N

TS Member

That's poor!I've also notice on the Merlin Holiday Club, that they are charging around £35 to £50 more for an accessible lodge compared to a non accessible lodge in the EV

On the Alton Towers site, there is no difference between the accessible lodges and non accessible lodges, but obviously at a higher price than those on the Merlin Holiday Club site.

I agree with this. Merlin, as a Public Ltd Company, now, have (due to their own poor management), gotten themselves into a viscous cycle.

They can, either, invest heavily to try and regain guest attendance and improve face/satisfaction, yielding higher attendances in the future. This, on the other hand, would result in an unacceptable short term loss which wouldn't be accepted by the company's shareholders. Alternatively, and with their current approach: erode the core product and *attempt* to increase total spend per customer, which will result in customer dissatisfaction, and lower attendances.

It is also of my belief that Merlin's key figures: Nick Varney, Justin Platt and the new French CFO who I can't remember have presided over the utter deterioration of their parks and their current state. It is also worth noting that this management have put themselves in a situation where they actually have very little power if they want to keep their jobs.

My conclusion is two-fold: I can assure you if they increased operating costs and improved the core product in favour of increased profits, the shareholders would be ousting Nick at the next AGM. I can also conclude that the ultimate failings of this company in respect to their RTP division was the flotation of the business.

Anyone else agree?

Going public is probably one of the worst decisions to make if you want to retain control of your business, it might bring short term gains, but also comes with long term pains.

James

TS Founding Member

Won't be too long now till we see the park only open school holidays and weekends.

Cuts aren't surprising really, Merlin make severe cuts each year. It's just a game of what cuts will they make this year. Hopefully this nears us more towards the demise of Merlin Entertainments.

Sent from my LG-H870 using Tapatalk

Cuts aren't surprising really, Merlin make severe cuts each year. It's just a game of what cuts will they make this year. Hopefully this nears us more towards the demise of Merlin Entertainments.

Sent from my LG-H870 using Tapatalk

I've also notice on the Merlin Holiday Club, that they are charging around £40 more for an accessible lodge compared to a non accessible lodge in the EV

On the Alton Towers site, there is no difference between the accessible lodges and non accessible lodges, but obviously at a higher price than those on the Merlin Holiday Club site.

I got a reply from Alton Towers on this

"Hi Roy, this is very strange. We will have our team look into this."

Skyscraper

TS Member

And how funny is it that both lodges in the screenshot look exactly the same! (probs the same one)I got a reply from Alton Towers on this

"Hi Roy, this is very strange. We will have our team look into this."

Matt.GC

TS Member

That's still even fewer days that standard pass holders can't visit. They've already been told they can't visit during peak in August and 1st and 2nd September and have now been told that there's even fewer remaining open days left to choose from during September and October.Standard pass exclusions only apply for August & 1st, 2nd September. So the midweek closure has no impact in that regards.

tp

TS Member

All those closed days next year !

although they have Scarefest running all the way till fireworks !

Thank goodness! This year it closed on Tuesday (Halloween) of the South Yorkshire half term, so I didn't make it! Glad they've realised not all surrounding areas have the same half term week!

bluesonichd

TS Member

I predict Twirling Toadstool to return and Duel to close for TLC the entire season.Does anyone think any rides will leave or return for the 2018 season?

venny

TS Member

I sort of think that opening times have got to be governed more and more by the accommodation offering with Merlin seemingly relying more and more on this revenue stream. There’s therefore got to come a point where the cost savings of closing the park eat into accommodation bookings too much.

Whether they’re even making this link is another thing. It could well just be another blinkered decision of ‘if we close the park more days we’ll save more money’. If they have made the link then surely the number of closed days is now at a critical point of impacting people booking into the hotels.

Whether they’re even making this link is another thing. It could well just be another blinkered decision of ‘if we close the park more days we’ll save more money’. If they have made the link then surely the number of closed days is now at a critical point of impacting people booking into the hotels.